Small Molecule API Market Forecast to Reach USD 374.03 Billion by 2035 Driven by Investments and North American Collaborations

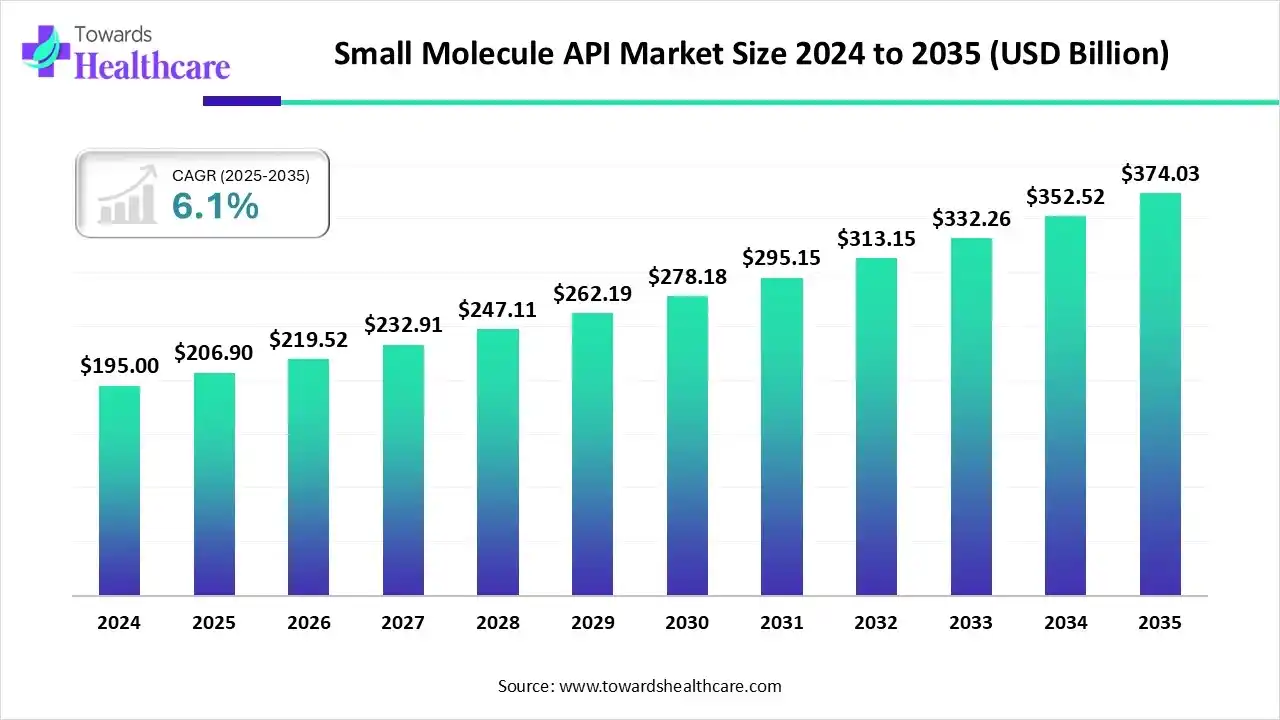

The global small molecule API market size was valued at USD 206.9 billion in 2025 and is predicted to hit around USD 374.03 billion by 2035, rising at a 6.1% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Jan. 06, 2026 (GLOBE NEWSWIRE) -- The global small molecule API market size is calculated at USD 219.52 billion in 2026 and is expected to reach around USD 374.03 billion by 2035, growing at a CAGR of 6.1% for the forecasted period, driven by the expanding healthcare applications and growing innovations.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6439

Key Takeaways

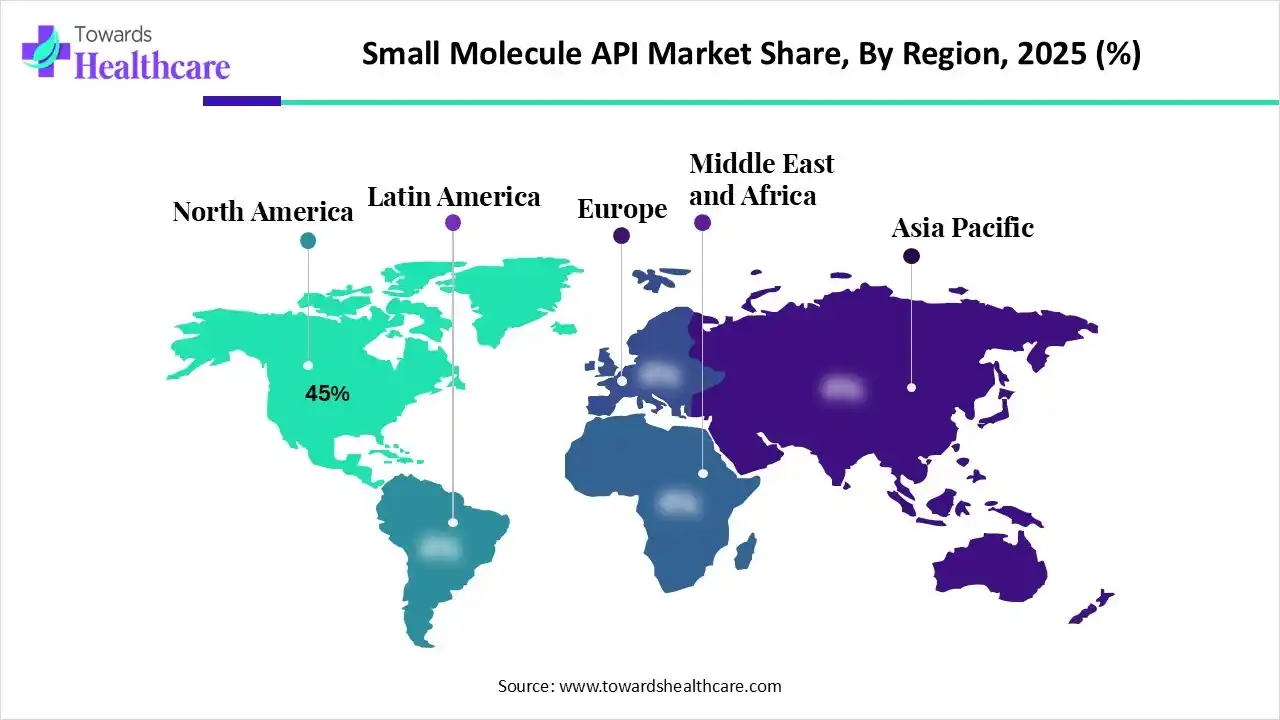

- North America held a major revenue share by 45% of the market in 2025.

- Asia Pacific is expected to witness the fastest growth in the small molecule API market during the forecast period.

- By product type, the branded/innovator small-molecule APIs segment held a major revenue share of the market in 2025.

- By product type, the generic/merchant APIs segment is expected to witness the fastest growth in the market during the forecast period.

- By therapeutic area, the oncology segment held a major revenue share of the market in 2025 and is expected to witness the fastest growth in the market during the forecast period.

- By molecule/chemistry type, the small molecule organic APIs segment held a major revenue share of the market in 2025.

- By molecule/chemistry type, the peptidomimetics & small peptides segment is expected to witness the fastest growth in the market during the forecast period.

- By dosage/formulation, the oral solid dose APIs segment held a major revenue share of the market in 2025.

- By dosage/formulation, the injectables segment is expected to witness the fastest growth in the market during the forecast period.

- By end-user, the pharmaceutical innovator companies & MNCs segment held a major revenue share of the market in 2025.

- By end-user, the generic drug manufacturers segment is expected to witness the fastest growth in the market during the forecast period.

What is the Small Molecule API?

The small molecule API market is driven by increasing chronic diseases, advancements in drug development technologies, and a growing geriatric population. The small molecule API refers to the chemical compounds used as an active ingredient in a drug, consisting of low molecular weight. They are used for the treatment, management, and control of various diseases like infectious diseases, cardiovascular diseases, cancer, etc.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What are the Major Growth Drivers in the Small Molecule API Market?

Increasing demand for affordable treatment options is the major driver in the market. This, in turn, is driving the development and adoption of affordable small molecule APIs in order to develop various cost-effective treatment solutions compared to biologics. Additionally, increasing demand for generic products, oral formulations, and a growing R&D pipeline are other market drivers.

What are the Key Drifts in the Small Molecule API Market?

The market has been expanding due to the growing investments and funding to launch and enhance the use of various genotyping technologies.

- In December 2025, plan to invest more than $6 billion in the Eli Lilly and Company facility in Huntsville, Alabama, was announced, where the capital will be used to support the development of small molecule synthetic and peptide medicines.

- In December 2025, to enhance the development and testing of small molecules, a total of $95 million was secured by Excelsior Sciences, which will be utilized to develop technology powered by machines and AI.

What is the Significant Challenge in the Small Molecule API Market?

Stringent regulations act as a major challenge in the market. The small molecule API and product development must comply with the regulatory standards, where their failure delays their approval and reduces their innovations. Moreover, supply chain vulnerability and competition from biologics act as other market restraints.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Regional Analysis

Why did North America Dominate the Small Molecule API Market in 2025?

In 2025, North America captured the biggest revenue share by 45% in the market, due to the presence of robust industries. At the same time, the presence of advanced manufacturing facilities and R&D investments also increased the production and innovations of the small molecule APIs. Moreover, growing chronic diseases also increased their use, which contributed to the market growth.

What Made the Asia Pacific Grow Rapidly in the Small Molecule API Market in 2025?

Asia Pacific is expected to show the fastest growth in the market during the forecast period, due to expanding industries, where the presence of affordable manufacturing facilities is driving the development of cost-effective small molecule APIs. Additionally, the presence of generic hubs, along with government support, is increasing their innovations, enhancing the market growth.

Segmental Insights

By product type analysis

Why Did the Branded/Innovator Small-Molecule APIs Segment Dominate in the Small Molecule API Market in 2025?

By product type, the branded/innovator small-molecule APIs segment led the market in 2025, due to their patent protection, which offered high profits. Moreover, continuous innovations and investments also promoted their new launches, which increased their use across the healthcare sector.

By product type, the generic/merchant APIs segment is expected to show the highest growth during the predicted time, driven by their affordability. At the same time, the growing outsourcing trends, patent expirations, and increasing access to these products are also increasing their acceptance rates.

By therapeutic area analysis

Which Therapeutic Area Type Segment Held the Dominating Share of the Small Molecule API Market in 2025?

By therapeutic area, the oncology segment held the dominating share of the market in 2025 and is expected to show the fastest growth rate during the predicted time, due to its increased incidence rates. Moreover, the limited curative treatment also increased the demand and adoption of the small molecule API to develop advanced therapies.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By molecule/chemistry type analysis

What Made Small Molecule Organic APIs the Dominant Segment in the Small Molecule API Market in 2025?

By molecule/chemistry type, the small molecule organic APIs segment led the market in 2025, due to a wide range of applications. Moreover, their stability and affordability also attracted the patient, which in turn promoted their large-scale production. The regulatory support also promoted their advancements.

By molecule/chemistry type, the peptidomimetics & small peptides segment is expected to show the highest growth during the upcoming years, driven by their target-specific action. Furthermore, they are also being used in the treatment of metabolic disease and cancer cases, which is increasing their innovations.

By dosage/formulation analysis

How the Oral Solid Dose APIs Segment Dominated the Small Molecule API Market in 2025?

By dosage/formulation, the oral solid dose APIs segment held the largest share of the market in 2025, driven by their easy administration, which enhanced patient convenience. Additionally, their affordable manufacturing, widespread availability, and long shelf-life increased their use in the treatment of various chronic diseases.

By dosage/formulation, the injectables segment is expected to show the fastest growth rate during the upcoming years, as they offer enhanced bioavailability and high efficacy. This, in turn, is increasing their demand in emergency conditions as well as complex and chronic disease treatment.

By end-user analysis

Why Did the Pharmaceutical Innovator Companies & MNCs Segment Dominate in the Small Molecule API Market in 2025?

By end-user, the pharmaceutical innovator companies & MNCs segment led the market in 2025, due to growth in the R&D investments, which promoted innovations. At the same time, they also launched new small molecule products, which were supported by patents, where the branded products were increasingly adopted for various applications.

By end-user, the generic drug manufacturers segment is expected to show the highest growth during the upcoming years, due to growing patent expiries. This is creating opportunities for the development of affordable small molecule APIs. These are also being supported by government funding and investments.

Recent Developments in the Small Molecule API Market

- In May 2025, to enhance the development and manufacturing of small-molecule API, a Design2Optimize platform was launched by Lonza.

- In April 2025, positive topline Phase 3 results of Orforglipron, which is the first oral small molecule glucagon-like peptide-1 (GLP-1) receptor agonist, were announced by Eli Lilly and Company.

Browse More Insights of Towards Healthcare:

The global insulin API market size is calculated at US$ 4.51 billion in 2025, grew to US$ 4.94 billion in 2026, and is projected to reach around US$ 10.21 billion by 2034. The market is expanding at a CAGR of 9.52% between 2024 and 2034.

The global berberine API market size is estimated at US$ 523 million in 2024 and is projected to grow to US$ 556.74 million in 2025, reaching around US$ 973.13 million by 2034. The market is projected to expand at a CAGR of 6.45% between 2025 and 2034.

The global oncology API market size is calculated at USD 41.79 billion in 2024, grew to USD 43.95 billion in 2025, and is projected to reach around USD 69.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

The global steroid hormone API market size is calculated at US$ 3.54 billion in 2024, grew to US$ 3.74 billion in 2025, and is projected to reach around US$ 6.06 billion by 2034. The market is expanding at a CAGR of 5.54% between 2025 and 2034.

The global serum gonadotrophin API market size was estimated at US$ 131 million in 2024, projected to increase to US$ 137.1 million in 2025 and reach US$ 202.93 million by 2034, showing a healthy CAGR of 4.64% across the forecast years.

The global non-ionic contrast media API market size is calculated at US$ 1.81 billion in 2024, grew to US$ 1.92 billion in 2025, and is projected to reach around US$ 3.32 billion by 2034. The market is projected to expand at a CAGR of 6.34% between 2025 and 2034.

The clavulanic acid series API market was estimated at US$ 385 million in 2023 and is projected to grow to US$ 777.66 million by 2034, rising at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2034.

Small Molecule API Market Key Players List

- Cambrex Corporation

- Lonza Group

- Bachem

- Catalent Inc.

- Aurobindo Pharma

- Siegfried Group

- Dr. Reddy’s Laboratories

- Divi’s Laboratories

- Jubilant LifeSciences

- Sun Pharmaceutical Industries

- Teva Pharmaceuticals

- Granules India

- Novartis

- Pfizer

- Sandoz

- Merck KGaA

- Hikal Ltd.

- WuXi AppTec

- Famar

- Piramal Pharma Solutions

- Cipla

- Fareva

- Lupin

- EuroAPI

- Glenmark

Segments Covered in The Report

By Product Type

- Branded/Innovator Small-Molecule APIs

- Generic/Merchant APIs

- High-Potency APIs (HPAPIs) & Cytotoxics

- Sterile Small-Molecule Injectables

- Controlled Substances & Others

By Therapeutic Area

- Oncology

- Cardiovascular & Metabolic (incl. diabetes)

- CNS (neurology, psychiatry)

- Anti-infectives (antibiotics, antivirals)

- Respiratory & Immunology

- Others (dermatology, gastrointestinal, ophthalmic, etc.)

By Molecule/Chemistry Type

- Small Molecule Organic APIs

- Peptidomimetics & Small Peptides

- Heterocyclic & Specialty Scaffolds

- Chiral/Enantiomeric APIs

By Dosage/Formulation

- Oral Solid Dose APIs

- Injectables (sterile small-molecule injectables)

- Topicals

- Inhalation

- Other Delivery Forms

By End User

- Pharmaceutical Innovator Companies & MNCs

- Generic Drug Manufacturers

- CDMOs/Contract Manufacturers

- Research Institutes & Emerging Biotech

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6439

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.